Unlisted Securities are Stocks of companies that are not listed on the exchange(NSE/BSE) and can’t be traded(bought/sold) via a broker(Zerodha, Groww, etc.) terminal/app. In this article, we will explore Unlisted Securities, the Investment Risks Involved, and How to Buy Unlisted Shares.

Table of Contents

ToggleWhat are Unlisted Shares?

A Share in a company represents ownership in that company. When you hear the term Unlisted Shares all it means is that shares have not yet been listed on the stock exchange, but the shares are very much there.

These shares are not with the public but instead, it’s in the hands of the company’s promoters, maybe some friends or family members. employees, strategic partners, etc.

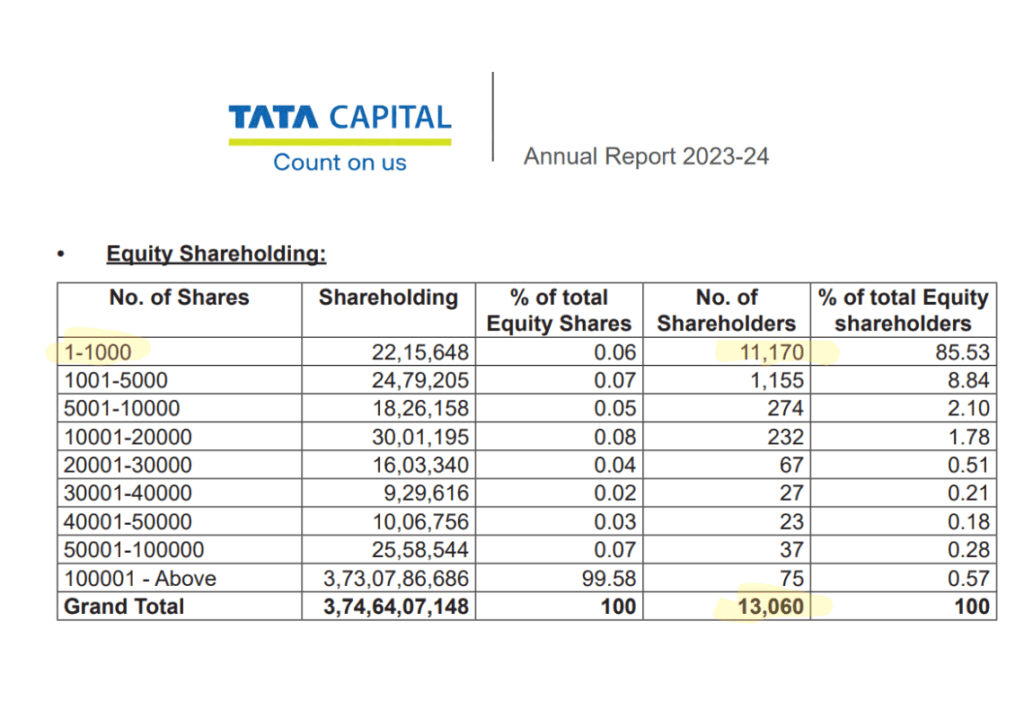

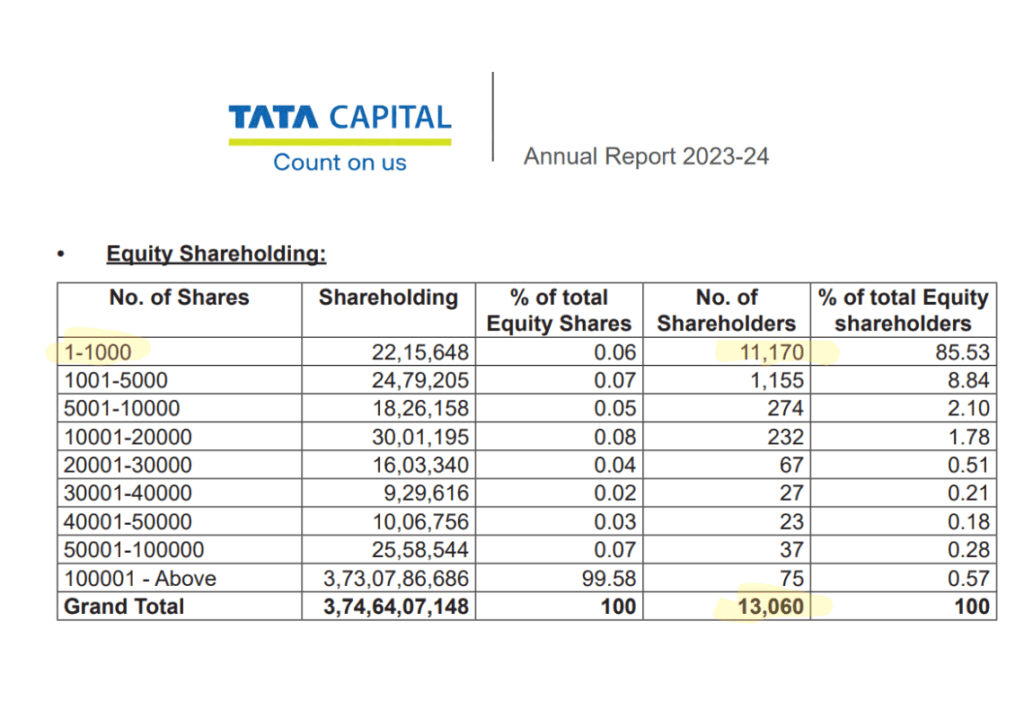

For Example, we will go through Tata Capital Equity Shareholding as of 31st March 2024 as per FY24 Annual Report which is an unlisted company as of October 2024.

There were 13,060 shareholders in this unlisted company as of 31st March 2024 out of which 11,170 shareholders have less than 1000 shares. But very interestingly the bulk of the shares 99.58% was held by 75 shareholders.

Most shareholders in Unlisted shares that go up for trading prior to an IPO are generally from a lot that holds shares between 100 – 30000. (First 5 rows in the image above). But as a collective % of total equity shares they have is only 0.30%.

of course, this number will differ by company, but typically the people who offer their pre-IPO shares include ex-employees, Angel Investors, Board Members, friends and family members of the founder, etc.

Where Unlisted Shares are traded?

Unlisted Shares are bought and sold Over the Counter(OTC). This means there are no open marketplaces like NSE or BSE. These shares are traded directly between buyers and sellers often through Brokers, Private Deals, or specialized platforms.

The OTC(Over-the-counter) market is also called the Grey Market. The term Grey market might seem fishy or something illegal is going on, but the fact is trading in unlisted shares is not illegal in India.

A Grey Market is simply a network of brokers and traders who buy and sell unlisted shares for themselves or their organization.

How to Buy Unlisted Shares?

There are multiple platforms where we can buy and sell Unlisted Shares. A few of the popular ones are listed below.

InCred Money, Precize, Unlisted Zone , Stockify, Sharescart etc are few popular platforms to buy unlisted shares.

👉 Check out How to Filter Quality Penny Stocks with Immense Growth Potential based on 11 Fundamental Analysis Criteria.

👉 Check out How to Invest in 33 EV Stocks once via the Nifty EV Index.

👉 Everything about the Nifty India Defence Index with a whooping 84% CAGR in the last 3 years and how to invest in it.

How to Buy Swiggy Shares before IPO?

If you want to buy Swiggy Shares or any Unlisted company’s shares like NSE, OYO, boat, etc there are multiple ways you can buy unlisted shares.

You can approach Swiggy’s investment banker who is helping the company float its IPO or you can use any of the above-mentioned platforms to buy Unlisted Shares.

But the point to be noted is you can’t buy just one share or 50 shares like in the case of listed shares. Each Platform or intermediary will have a certain minimum amount of Ticket size/Lot size.

For Example, on Sharescart and Unlisted zone, the minimum ticket size for Swiggy is somewhere between ₹30,000 to ₹50,000. On InCred Money, you will have to buy a minimum of 1401 shares ₹399 each. On Precize you can buy a lot of 21 shares at ₹10,297.

Coming to the next important point At What Price? There is No Fixed Price. Swiggy’s Investment Banker sold some shares at ₹345 each. And if you check prices on different websites each platform has a different quote.

- Precize: ₹479

- Unlisted Zone: ₹485

- Stockify: ₹462

- Sharescart: ₹485

Note: All Prices are as of 19th October 2024.

Clearly, there is no transparency in price setting, which means it’s a huge risk to put your money here.

Risks of Investing in Unlisted Shares

- Loss of Capital: If the unlisted company fails to perform or if it goes bankrupt then your entire capital can be at risk.

- Lack of Liquidity: One might find it difficult at times to buy or sell your unlisted shares. There might not be a buyer when you want invested money back by selling the stock.

- Lack of Regulations: In the case of Listed shares trading SEBI has extremely strict rules that ensure the companies do not do any funny business.SEBI requires companies to disclose everything even minor changes. But, none of this happens in the case of Unlisted Companies.

- Dilution: As more investors are issued shares on account of ESOPs, rights issues, preferential allotment, etc the value and ownership of an existing shareholder does reduce.

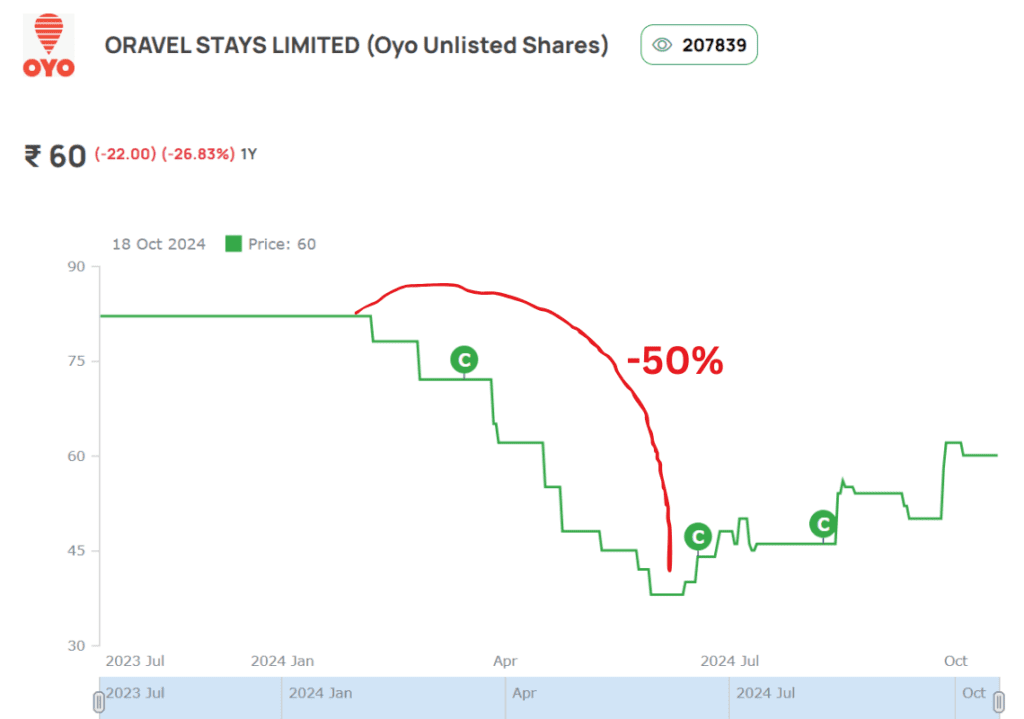

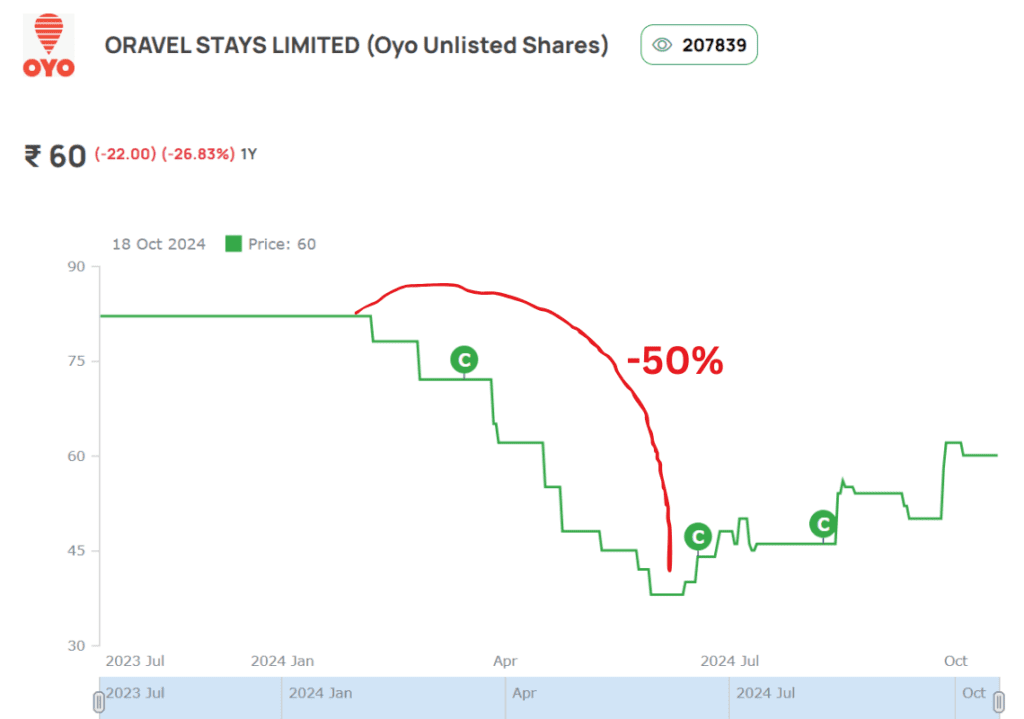

- Postponement of IPO: If the IPO itself gets delayed for any reason, in this case, the Price of unlisted shares might drop. This happened in the case of OYO(ORAVEL STAYS LIMITED).

After OYO withdrew its draft prospectus in May 2024, but the indications were there in February itself you can notice the price declining from 76 in mid-February to 38 rupees in early June 2024 which is a 50% drop in company’s share price.

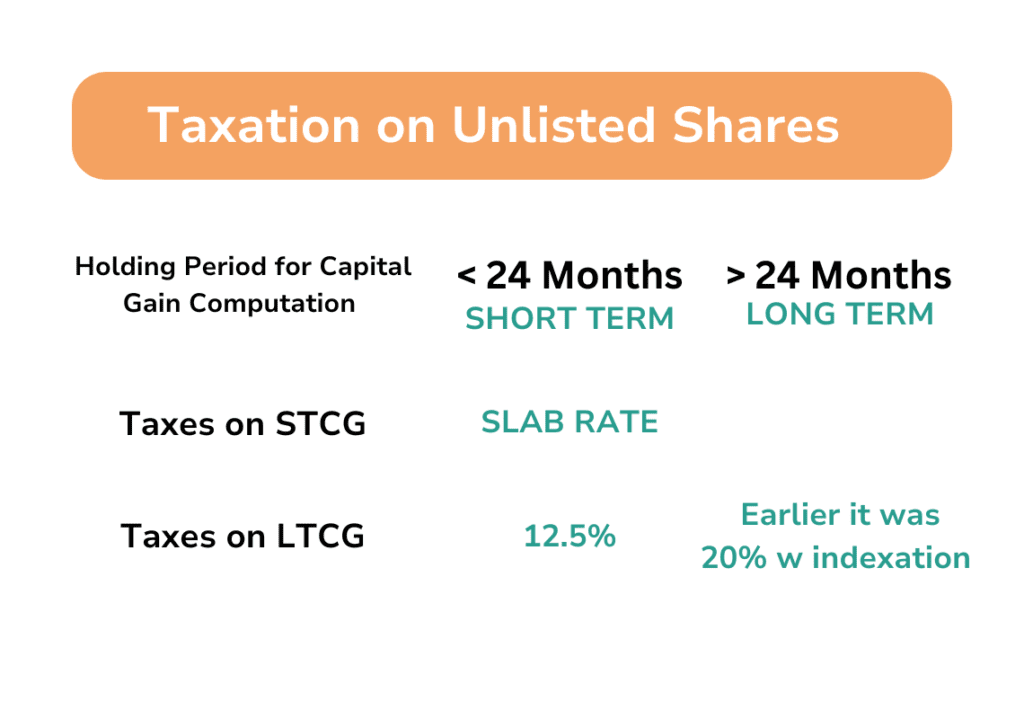

- Higher Taxes: For unlisted shares, LTCG (Long-Term Capital Gain) will be 20% with Indexation, and for STCG(Short-Term Capital Gain), it is as per your Slab Rate. The duration for Long-Term Capital Gain for unlisted shares is not 12 months; instead, it is 24 months.

- Limited Company-Specific Data: As we know, unlisted shares are not regulated by SEBI. Therefore, comparatively fewer disclosures are required, and that is why you will not get ample data to analyze the company.

- High Commissions: Whoever is the seller of the unlisted shares, be it a person or an online platform might charge a very high commission.

Taxation on Unlisted Shares

The Holding period in the case of unlisted stocks should be at least 24 months to be considered as long-term. If the holding period is less than 24 months then it will be considered as Short Term.

If an unlisted share is sold after 24 months then LTCG(Long Term Capital Gain) will be applicable otherwise STCG(Short Term Capital Gain) will be applicable.

STCG in the case of unlisted shares is according to the investor’s Slab Rate/Income Tax Slab, while LTCG will be taxed at 12.5% which was earlier 20% with the indexation benefits.

How to Sell Unlisted Shares?

It is very important to understand the exit strategies after buying unlisted shares. Means how you can sell the unlisted shares after byiung it.

- IPO: Unlisted shares can be sold after IPO once the stock gets listed on NSE/BSE. One important point to note here is that once the IPO is launched and the ISIN is frozen (Just before the IPO) you won’t be able to sell your shares for the next 6 Months.

- Buyback offer by the company: The company itself comes with a buyback, you can offer your shares for the buyback.

- Transfer: Transfer the share privately to someone directly from your demat account to his/her Demat account.

- Sell on Online platforms: You can also sell unlisted shares before IPO on any of the above mentioned online platforms like InCred or Unlisted Zone. It may take some time to find the buyer and liquidate the stocks and obviously, the platform will charge its commission.

Frequently Asked Questions about Unlisted Shares

Is Buying & Selling unlisted shares legal in India?

Yes, Buying and Selling Unlisted Shares before an IPO is Legal in India. Unlisted Shares can be traded in the OTC market and often involve Brokers and dealers, but what’s gaining prominence are online platforms like InCred, UnlistedZone, Precize, etc.

What are the Benefits of Investing in Unlisted Shares?

Many pre-IPO/Unlisted Shares hold the potential to become future multibaggers, as the IPO process often injects significant growth capital into these companies allowing them to expand operations, improve profitability, and ultimately enhance shareholder value.

Is there any Lock-in period after buying unlisted shares?

Once the company decides to launch an IPO, then Just before the IPO when the ISIN is frozen shares can’t be sold. Shares then can be sold after 6 months of the IPO.

What are charges of Brokers & Platforms who deals in Unlisted Shares?

There are typically 2 types of charges involved in trading in unlisted shares:

- Transaction Fees: This depends from platform to platform. This not only includes online platforms but also brokers and all kinds of offline intermediaries as well. It may vary from 2% to 5%.

- Markup % on buying & selling price: This one is a bit more subtle. Brokers will tell you the buying or selling price of each share after increasing or decreasing it and the difference will be their profit. For example, if someone wants to sell their shares at 400 the broker will quote the price of 410 for each share to the buyer.

Where can you see the Bought Unlisted Shares?

When you register yourself on any online platform like InCred you will have to provide your demat account details. And once you buy the Unlisted shares they will go into your demat account.

If your depository is CDSL you can download CDSL myeasi app to check your demat holdings. If your depository is NSDL then you can use NSDL speede app to check your demat holdings. Alternatively, you can also check check Unlisted shares in the demat holding section of your broking account.