The Nifty EV & New Age Automotive Index consists of 33 companies/stocks from various sectors like Automobile and Auto Components, Information Technology, Chemicals, Capital Goods, Consumer Services, and Oil, Gas & Consumable Fuels. It aims to track the performance of companies that are active in electric vehicles or new-age automotive vehicles (such as hybrid vehicles, hydrogen fuel-based vehicles, etc) segment. It also provides an exciting opportunity for investors to invest in the EV Ecosystem in a balanced way without much risk and benefit from the tremendous growth of the Electric Vehicle Industry.

We will go into detail about constituents and their weightage in this index, including financials, ETFs for Nifty EV, and how to invest in Nifty EV & New Age Automotive Index. Let’s get Started 🚀.

Nifty EV & New Age Automotive Index Portfolio

| Methodology | Periodic Capped Free Float |

| No. of Constituents | 33 |

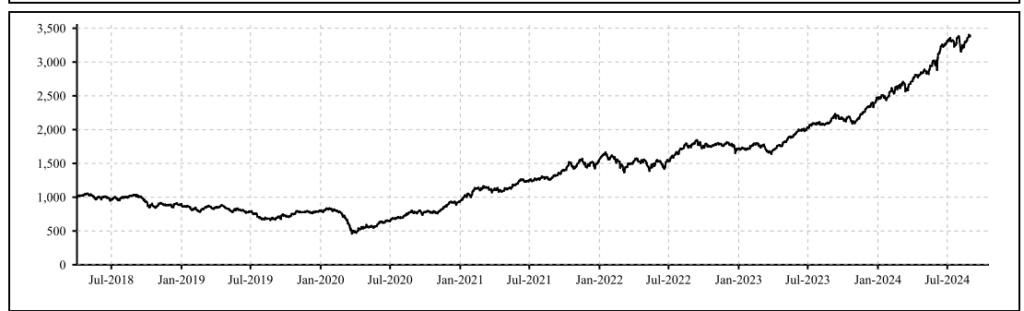

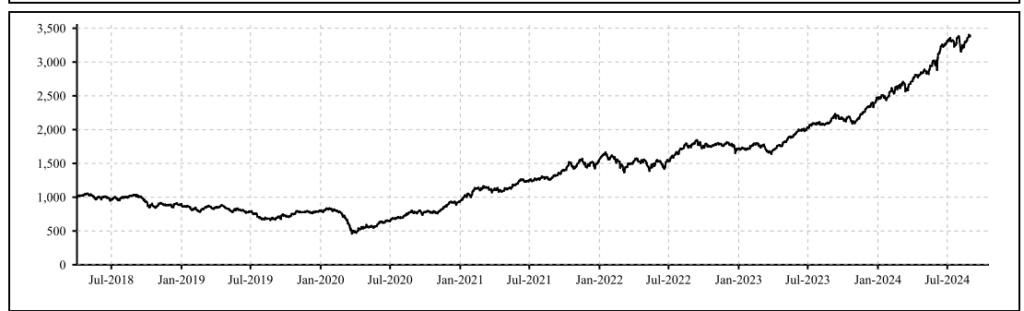

| Base Date | 02 April, 2018 |

| Base Value | 1000 |

| Launch Date | 30 May, 2024 |

| Calculation Frequency | End of day |

| Index Rebalancing | Semi-Annually |

Free Float Methodology is a financial procedure to calculate the market capitalization of the stock market’s index. In the Free Float Methodology market capitalization is calculated by multiplying the price of a company’s equity share by the number of shares available in the market.

This means in Free float Methodology while calculating the Market Cap the shares that are locked in by Promoters, Government, Insiders, etc are excluded from the calculation, only the shares that are available to trade in the market are included. It also means that Free Float market Cap. will be lower than the actual market cap and the Nifty EV & New Age Automotive Index uses the Free Float Methodology to calculate the Market Cap of the Index.

Nifty EV & New Age Automotive Index Top 10 Stocks List Constituents

| Company | Sector | Symbol | Weightage(%) |

| Tata Motors Ltd. | Automobile and Auto Components | TATAMOTORS | 9.84% |

| Bajaj Auto Ltd. | Automobile and Auto Components | BAJAJ-AUTO | 8.61 |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | MARUTI | 7.81 |

| Mahindra & Mahindra Ltd. | Automobile and Auto Components | M&M | 7.36 |

| L&T Technology Services Ltd. | Information Technology | LTTS | 4.51 |

| KPIT Technologies Ltd. | Information Technology | KPITTECH | 4.39 |

| Tata Elxsi Ltd. | Information Technology | TATAELXSI | 4.30 |

| Sona BLW Precision Forgings Ltd. | Automobile and Auto Components | SONACOMS | 4.11 |

| Reliance Industries Ltd. | Oil, Gas & Consumable Fuels | RELIANCE | 3.96 |

| Samvardhana Motherson International Ltd. | Automobile and Auto Components | MOTHERSON | 3.86 |

Download Stocks List of all Companies listed in the Nifty EV & New Age Automotive Index

Nifty EV & New Age Automotive Index Constituents by Sector Weightage

| Sector | Weight(%) |

| Automobile and Auto Components | 68.36 |

| Information Technology | 14.58 |

| Chemicals | 8.20 |

| Capital Goods | 4.83 |

| Oil, Gas & Consumable Fuels | 3.96 |

| Consumer Services | 0.06 |

Nifty EV & New Age Automotive Index Financials

Fundamentals

- P/E(Price to Earning Ratio): 35.8

- P/B(Price to Book Ratio): 6.62

- Dividend Yield: 0.68

Nifty EV Index Returns

| 1 Year | 3 Years | 5 Years | Since Inception |

| 59.93% | 38.74 | 38.86% | 22.15% |

The Nifty EV index has a base date of April 02, 2018, and a base value of 1000.

Calculate the Exact CAGR(Compound Annual Growth Rate) for your SIP/Lumpsum Investment

How to invest in the Nifty EV & New Age Automotive Index?

You can Invest in the Nifty EV & New Age Automotive Index via ETFs (Exchange Traded Funds) and Mutual Funds. Till September 2024 there are Two ETFs (Exchange Traded Funds) and One Mutual Fund to Invest in the Nifty EV & New Age Automotive Index.

- Mirae Asset Nifty EV and New Age Automotive ETF

- Groww Nifty EV & New Age Automotive ETF FoF Direct Growth

- Groww Nifty EV & New Age Automotive ETF

Mirae Asset Nifty EV and New Age Automotive ETF

It is an open-ended Scheme tracking/replicating the Nifty EV & New Age Automotive Index. This ETF is trading on both NSE and BSE from any Broker. Mirae Asset Nifty EV and New Age Automotive ETF Code is EVINDIA on NSE and 544212 on BSE.

| P/E Ratio | R/B Ratio | Expense Ratio | Fund Manager | Founded Year | ETF Code |

| 32.78 | 5.56 | 0.40 | Ekta Gala and Akshay Udeshi | 2024 | NSE: EVINDIA BASE: 544212 |

Groww Nifty EV & New Age Automotive ETF

Groww Nifty EV & New Age Automotive ETF aims to generate long-term capital growth by investing in securities of Nifty EV & New Age Automotive Index in the same proportion.

| P/E Ratio | R/B Ratio | Expense Ratio | Fund Manager | Founded Year | ETF Code |

| 32.78 | 5.56 | 0.47 | Abhishek Jain | 2024 | GROWWEV |

Groww Nifty EV & New Age Automotive ETF FoF Direct Growth

Groww Nifty EV & New Age Automotive ETF FoF Direct Growth is an Equity Mutual Fund Launched by Groww in July 2024. It is rated as High Risk. The minimum SIP is set to ₹100 and the minimum Lumpsum Investment is set to ₹500. Exit Load of 1% if redeemed within 30 Days.

| P/E Ratio | R/B Ratio | Expense Ratio | Fund Manager | Founded Year |

| 32.78 | 5.56 | 0.19 | Abhishek Jain | 2024 |

-

What are the Stocks in the Nifty EV Index?

The Nifty EV & New Age Automotive Index consists of 33 companies/stocks from various sectors like Automobile and Auto Components, Information Technology, etc. The few popular and most weighted stocks in this Index are Tata Motors Ltd., Bajaj Auto Ltd., Mahindra & Mahindra Ltd., KPIT Technologies Ltd., Tata Elxsi Ltd., Sona BLW Precision Forgings Ltd., etc.

-

How Can I Invest in the Nifty EV Index?

You can Invest in the Nifty EV Index via ETFs(Exchange Traded Funds) and Mutual Funds. Popular ETFs for Nifty EV & New Age Automotive Index are Mirae Asset Nifty EV and New Age Automotive ETF, Groww Nifty EV & New Age Automotive ETF, and Groww Nifty EV & New Age Automotive ETF FoF Direct Growth Mutual Fund.

-

Is the Nifty EV & New Age Automotive Index Good for Investment?

Considering the demand for Electric Vehicles and Government Initiatives to promote the EV Ecosystem it can be a very good investment opportunity for a horizon of next 5-10 years. Since its Inception (Base Date April 2018) this Index has a CAGR of 22.15 which can be considered as a Good Return.