Mutual funds are a top-rated and balanced investment instrument that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds offer investors an easy way to access a broad range of assets, reducing risk through diversification.

But How to Measure Mutual Fund Return? How to compare mutual funds based on their returns? In this article, we will go step by step and learn How to measure mutual fund returns based on various parameters.

Mutual Fund Returns – Absolute, XIRR, CAGR

| Investment | Tenure | Return Measurement |

| Lumpsum | < 1 Year | Absolute Return |

| Lumpsum | > 1 Year | CAGR |

| SIPs/STPs | < 1 Year | Absolute Return |

| SIPs/STPs | > 1 Year | XIRR |

- If you did Lumpsum Investment and your Investment tenure/period is less than 1 year then you should use Absolute Return to calculate Returns of your Mutual Fund.

- If you did Lumpsum Investment and your Investment tenure/period is more than 1 year then you should use CAGR to calculate Returns of your Mutual Fund.

- If you are doing SIPs/STPs regularly on a certain interval and the tenure/period of the start of your SIP/STP is less than 1 year then you should again use Absolute Return.

- And if the tenure/period of the start of your SIP/STP is more than 1 year then you should use XIRR to calculate the return on your investment.

How to Calculate Absolute Returns for Mutual Funds?

Suppose on 10th January 2024, You Invested ₹50000 Lumpsum in a Mutual Fund. On 15th September 2024, the value of this investment is 75000. What is the Return Generated? Since the period is less than 1 year we will go for Absolute return. Calculating Absolute Return is very simple and straightforward.

Absolute Return = ( ( Current Value / Invested Value ) – 1 ) x 100

So, in our case, it will be ((50000/75000)-1) x 100 = 50%.

What is CAGR in Mutual Funds?

CAGR(Compound Annual Growth Rate) is a key parameter to calculate or analyze the growth of your investment over a period of time (usually more than 1 year). It tells you how your investment is Grown every year i.e. average Annual Growth of your investment, provided returns are re-invested every year. It is an important Ratio as it eliminates the short-term hiccups and fluctuations in returns and provides a clear picture of long-term Annual Growth Returns.

The Formula to Calculate CAGR is (((Current Value / Total Investment)1/years ) – 1 ) X 100.

If the Current Value of your Investment = CV, Total Investment = TI, and Years Invested = Y the formula to calculate CAGR is

CAGR% = (((CV / TI)1/years ) – 1 ) X 100

Let’s assume You Invested 50,000 on the 1st of January 2018 in a Mutual Fund. Four years later, the investment has grown to 90,000. What is the CAGR % of this Investment? Here your Current Value(CV) = 90,000, Total Investment(TI) = 50,000, and Years of Investment(Y) = 4. Hence Your CAGR will be

(((90000/50000)1/4 ) – 1 ) X 100 = 15.83 %

Since CAGR(Compound Annual Growth Return) tells us how investment is Grown Annually it is Best Suited for Lumsum investment which is invested for more than 1 Year. You can also calculate CAGR for SIP(Systematic Investment Plan), however, XIRR(Extended Internal Rate of Return) will be a more accurate indicator of return in the case of SIPs.

Check the CAGR Return of your Investment(SIP/Lumpsum) for Free

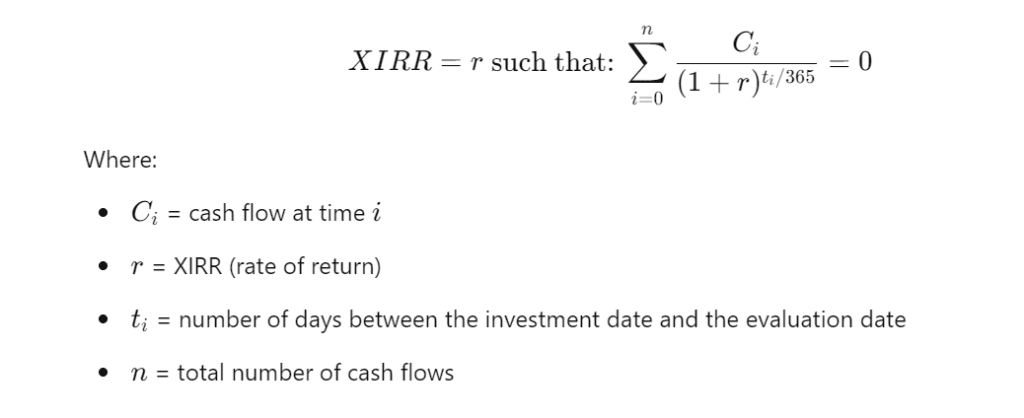

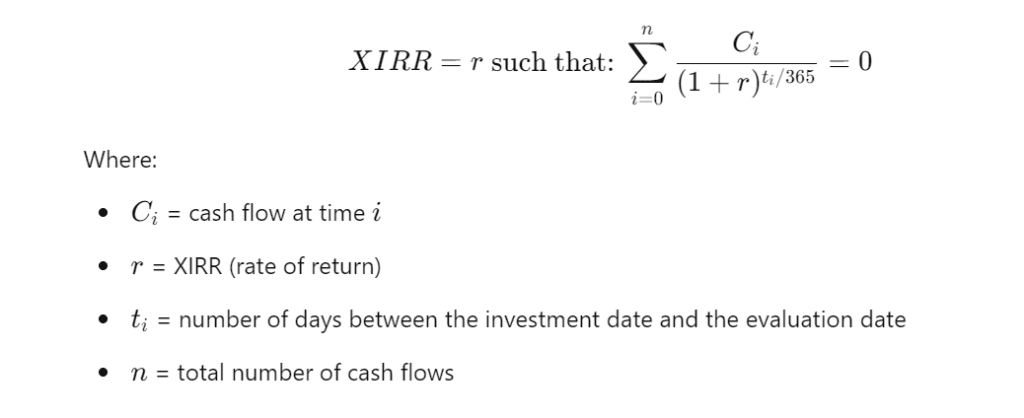

What is XIRR in Mutual Funds?

XIRR or Extended Internal Rate of Return is a financial tool that helps determine the rate of returns on mutual fund investment with a lot of uneven cash flows. Whereas the normal return computation methods do not factor in the time and quantity of each expense and earnings that occurred in the investment, the XIRR has been acknowledged as a more efficient investment return, particularly for investing that occurs in irregular instances, such as, through an SIP. It enables investors to arrive at precise and substantial results for the mutual fund they have invested in, and taking into account actual inflow and outflows it is a perfect tool for arriving at a realistic or real rate of return on investments.

You will be amazed to know that XIRR is not a Finance Concept. It is basically an Excel Formula that has become so popular that it is very commonly used to calculate the return on uneven cash flow. Let us understand with an example.

Know How you can benefit from the Tremendous Demand & Growth of Electric Vehicles & its Ecosystem, Everything you need to know About the Nifty EV & New Age Automotive Index, and how to Invest in it.

XIRR with an Example

Suppose An Investor invests 5000 per month in a Mutual Fund. After 20 Months, suppose the value of the Investment is 12,000/-. What is the Return here?

The first 5000 that was invested in 1st month remained invested for 20 months, but 2nd month 5000 remained invested for 19 months only, 3rd month 5000 remained invested for 18 months only, and so on the last 5000 remained invested only for 1 Month. Hence calculating Absolute return or CAGR in this type of investment will not be suitable or accurate. However, XIRR will give us more accurate returns since it takes the exact dates of investment into account.

How to Calculate XIRR for Mutual Funds?

- List All Cash Flows: Note Down all your Investments(Cash Outflows) as negative Values and Redemptions(Cash Inflows) as positive values.

- Record Dates: Alongside each cash flow, record the exact date of the transaction.

- Use the Formula: Once you have the amounts and dates, you can apply the XIRR formula either manually or using Excel Sheet Formula.

The Formula is a bit Complex and Confusing and is solved using iterative methods. However, you don’t need to solve it manually. Spreadsheets like Excel have a built-in Formula that simplifies this process.

Calculate XIRR using an Excel Spreadsheet

Create 2 columns in the Excel sheet. Column A(for Dates) and Column B(for Amount).

- Column A: Dates of Cash Flow(investment/redemptions)

- Column B: Amount( use – in front of Amount for inflows, and positive for outflows/redemption)

So, if you invested say on the 10th of each month for 19 months and withdraw on the 10th day of the 20th month. Then go to the formula tab and use the formula or =XIRR(B1:B20, A1:A20).

or you can Directly Download and Use this XIRR Calculator Excel Sheet. Just update dates and amounts according to your Investments. In the sheet just for example from the 10th of January 2024, I have invested 5000 every month till the 10th of March 2025. and withdrew 10000 in April. If the number of rows that is period of investment increases or decreases for you please adjust the formula by just clicking on the XIRR value in the bottom of column B.

You can also use this Calculator to calculate the Returns of your Mutual Fund.

If any Doubts let me Know in the Comments 😊.

What is the difference between XIRR and CAGR?

CAGR should be used to calculate the returns of Lumpsum Invest which has been Invested for more than 1 year. CAGR represents by what rate your investment has grown annually. XIRR(Extended Internal Rate of Return) should be used to calculate the return of systematic investments which is done over a period of time like SIPs/STPs.

What is a good XIRR for a mutual fund portfolio?

If the XIRR of your Mutual Fund Portfolio is more than 15% then it’s Good. and anything above 20% is very good. If you are getting 24 %XIRR. it means, in approx 3 years your money is doubling. Now just assume you have invested 10 lacs, after 30 years with 24 % XIRR, your money would become 100 crore. That is the power of compounding

What is a Good CAGR for Lumpsum Investment?

CAGR should be calculated for Lumpsum Investment if the period of Investment is more than 1 year. Anything between 15-20% CAGR return is considered a good return. If you are getting approx 25% CAGR returns from your Investment your Investment will double every 3 years provided the returns are re-invested.

Is 15% XIRR Considered Good?

The benchmark for Good XIRR return can be considered anything between 15%-20%.