In this article, we are going to learn How to Filter Quality Penny Stocks like a Pro Investor for yourself, and that too in a very short time. We will do this entire process together and learn how we can select quality Penny Stocks for long-term investment. Let’s get Started 🚀.

Table of Contents

ToggleWhat are Penny Stocks?

If seen in the context of the United States, every stock whose price is less than $1 is called a penny stock. According to Investopedia, every stock whose price is less than $5 is called penny stocks. But if we look at the Indian context, some people say that a stock worth less than Rs 10 is a penny stock, and some say a stock worth less than Rs 50 is a penny stock.

There is no clear definition of Penny Stocks, but as we all know, everyone wants to know about stocks that are very cheap to buy and will multiply quickly. But the priority should be Safety First. That is why it is important to understand How to Filter Quality Penny Stocks.

Generally, people call a stock a penny stock depending on its low price, but according to us, a stock does not become a penny stock just because the price is low, its market capitalization should also be low. Because whether a company is big or small depends on its market capitalization, not its price.

How to Filter Quality Penny Stocks?

Visit Screener Website

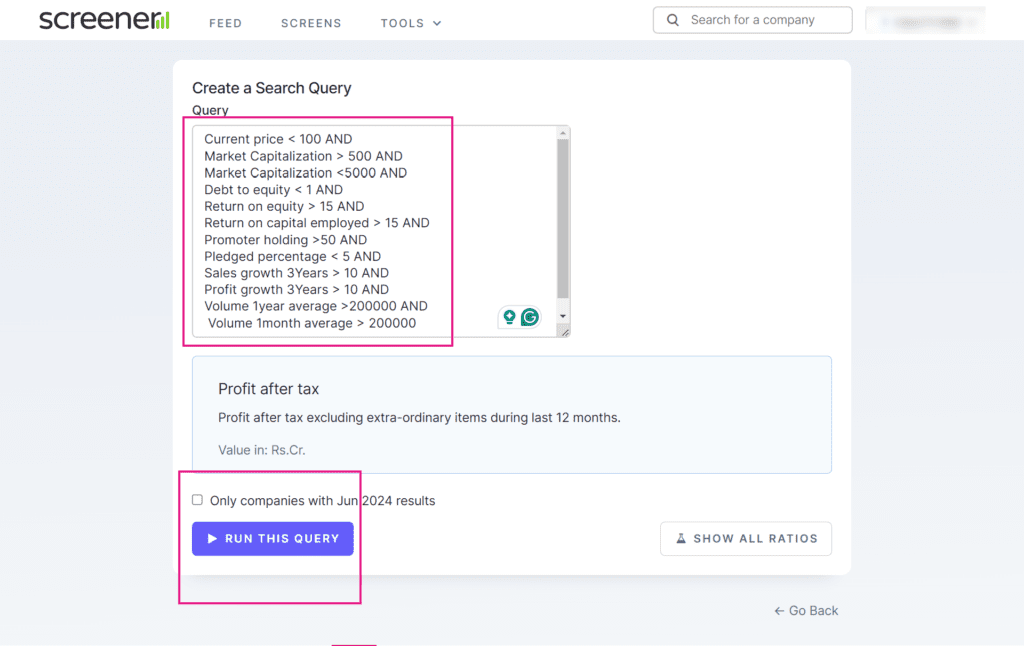

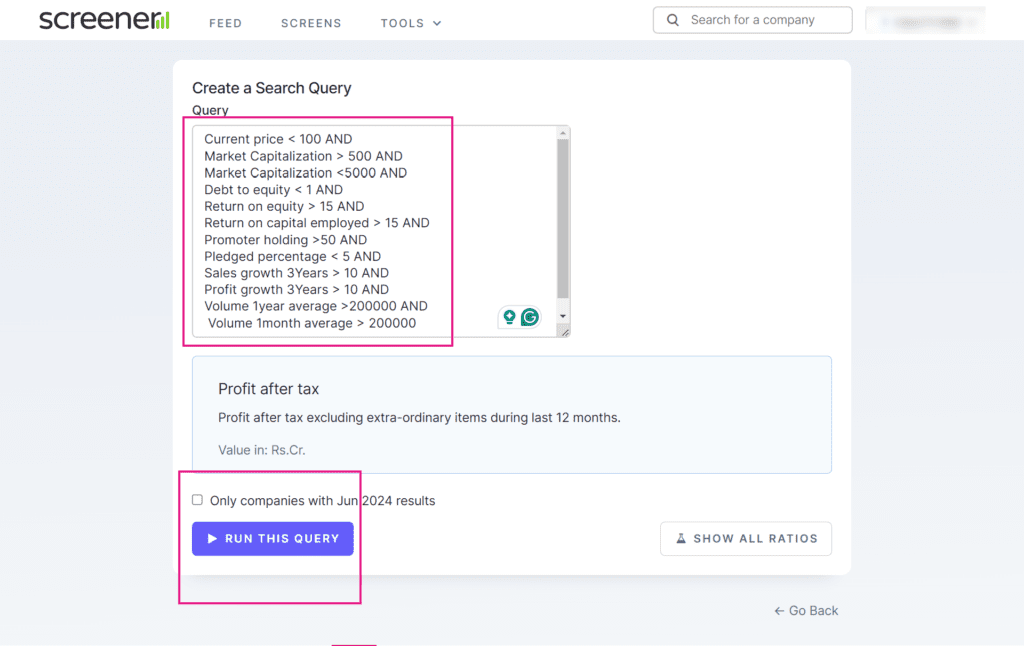

We are going to use screener.in to filter Penny Stocks. You can use any app of your choice to filter, we are going to use screener here. Using Screener we can Filter Stocks based on a few Queries and it is absolutely free.

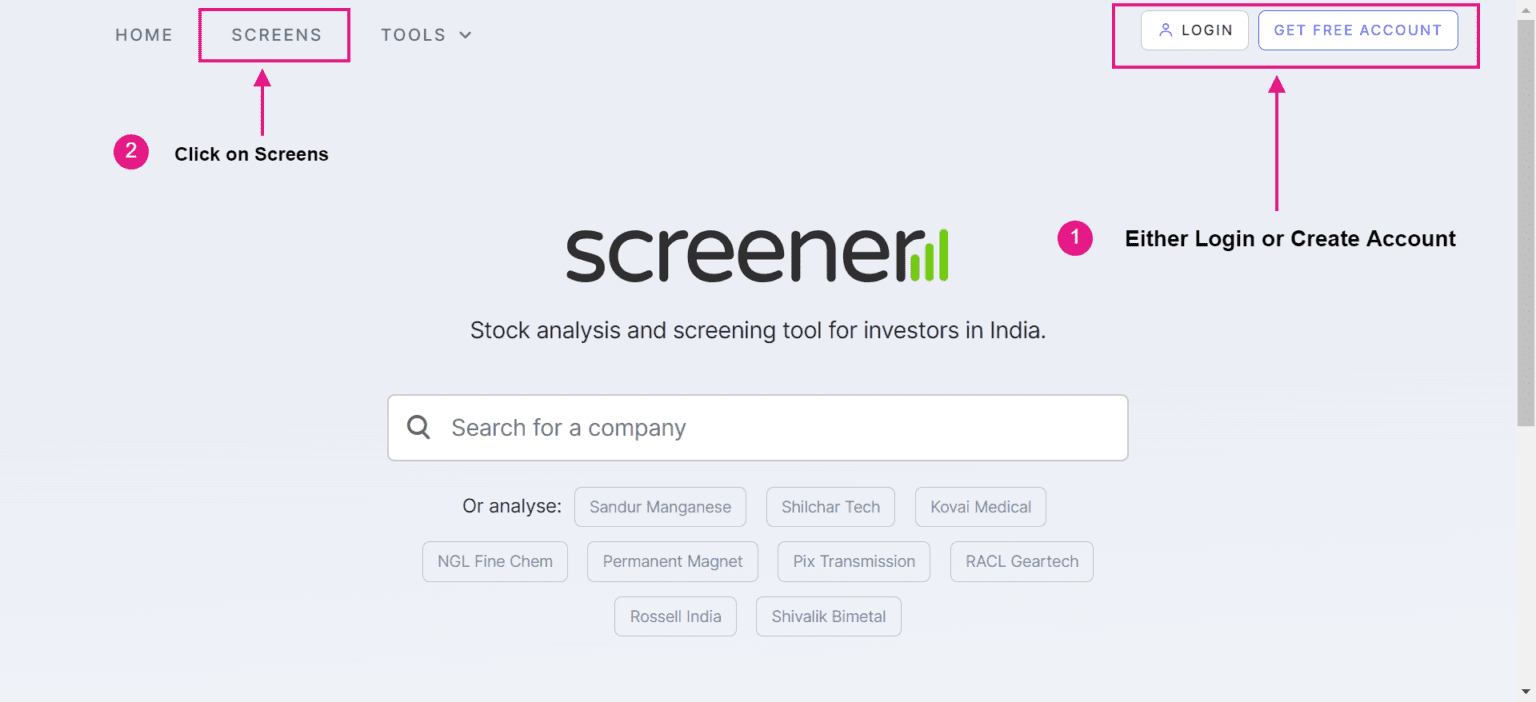

- Visit the screener website.

- If you are not logged in, please log in or sign up if you don’t have an account. You can log in or Sign up using Google/Gmail.

- Click on Screens as depicted in the first image above.

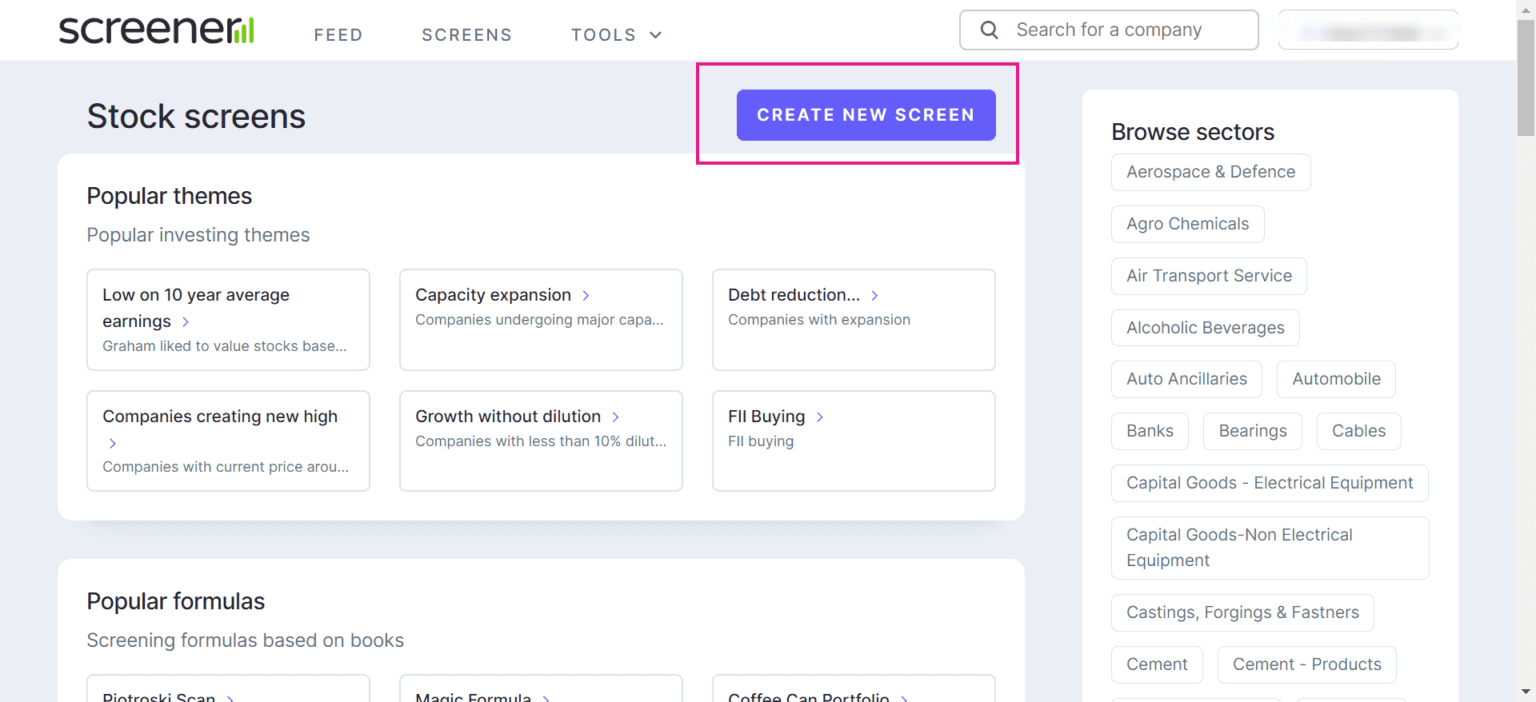

- Then Click on the Create New Screen Button as depicted in the 2nd image. Click on Images to Zoom In.

Criteria to Filter Penny Stocks

Below are the Parameters that we are going to use to understand How to Filter Quality Penny Stocks. These Criteria may vary from person to person but we have very strong reasons to use these criteria and values.

- The Current Price should be Less Than 100 Rupees: This is going to be our First Filter, which is all stocks whose price is less than 100 rupees.

- Market Capitalization Should be Greater than ₹500 Crores and less than₹ 5000 Crores: Market Cap is very important criterion. Less Price alone is not enough to decide whether a stock is penny stock or not. To be safe we will include companies whose market cap is greater than ₹500 Crores but not more than ₹5000 Crores.

- Debt to Equity Ratio should be less than 1: We are already looking for a small company and if the debt of that company is high then our risk will increase even more. Therefore, we will filter such companies whose debt to equity is less than 1 i.e. their debt is much less than their equity.

- Return on Equity(ROE) should be greater than 15: To run its business, the company can get money in two ways. One is by taking debt and the other is by selling one’s equity shares. The returns that a company generates on its equity capital is called Return on Equity.

- Return on Capital Employed(ROCE) should also be Greater than 15: How much return the company is generating on the total money that has come to the company by taking debt and selling equity shares is called Return on Capital Employed. This should also be more than 15% because the company has to pay interest on the loan.

- Promoter’s Holding Should be Greater than 30%: Promoters are those who own the company and run the company. If the promoters holding in a company is high then we can assume that the promoters have confidence in the company’s business and they are working on the growth of the company. If it is more than 50% then it is a good indicator, but practically in small companies, we can consider 30% promoters holding also good.

- Pledged Percentage should be less than 5%: Many times promoters have holdings but they have pledged them. If a loan is taken by pledging a little holding then there is no harm in it. But if they have pledged a lot of holding then it is not good for the company. In my opinion, it is better if the pledged percentage is less than 5%, you can also apply a filter of less than 10%.

- Sales Growth 3 Years should be Greater than 10%: We will benefit from the company only when the company’s sales are increasing or when its profits are increasing. It is important to note that sales growth of just one year does not matter much because it can happen due to different reasons, so we will consider sales growth of 3 years.

- Profit Growth 3 Years Should be Greater than 10%: Many times it is seen that the company’s sales are increasing but there is no growth in profits. Therefore, it is important to check the company’s profit growth as well.

- Volume 1 Year Average should be Greater than 200000: Volume is a very important criterion if you are investing in a Penny Stock. It is very important to have a good volume in it, because if the trading volume of that stock in the market is low then after buying, it is possible that you may not be able to sell that stock. And the stocks that have low volume, there are high chances of Pump and Dump Fraud.

- Volume 1 Month Average should be greater than 200000: In many Penny Stocks, due to pump and dump scam by operators, there will be a sudden high volume and then the volume will suddenly decrease. Hence, we will also consider 1 month Average Volume

Query to Filter Quality Penny Stocks

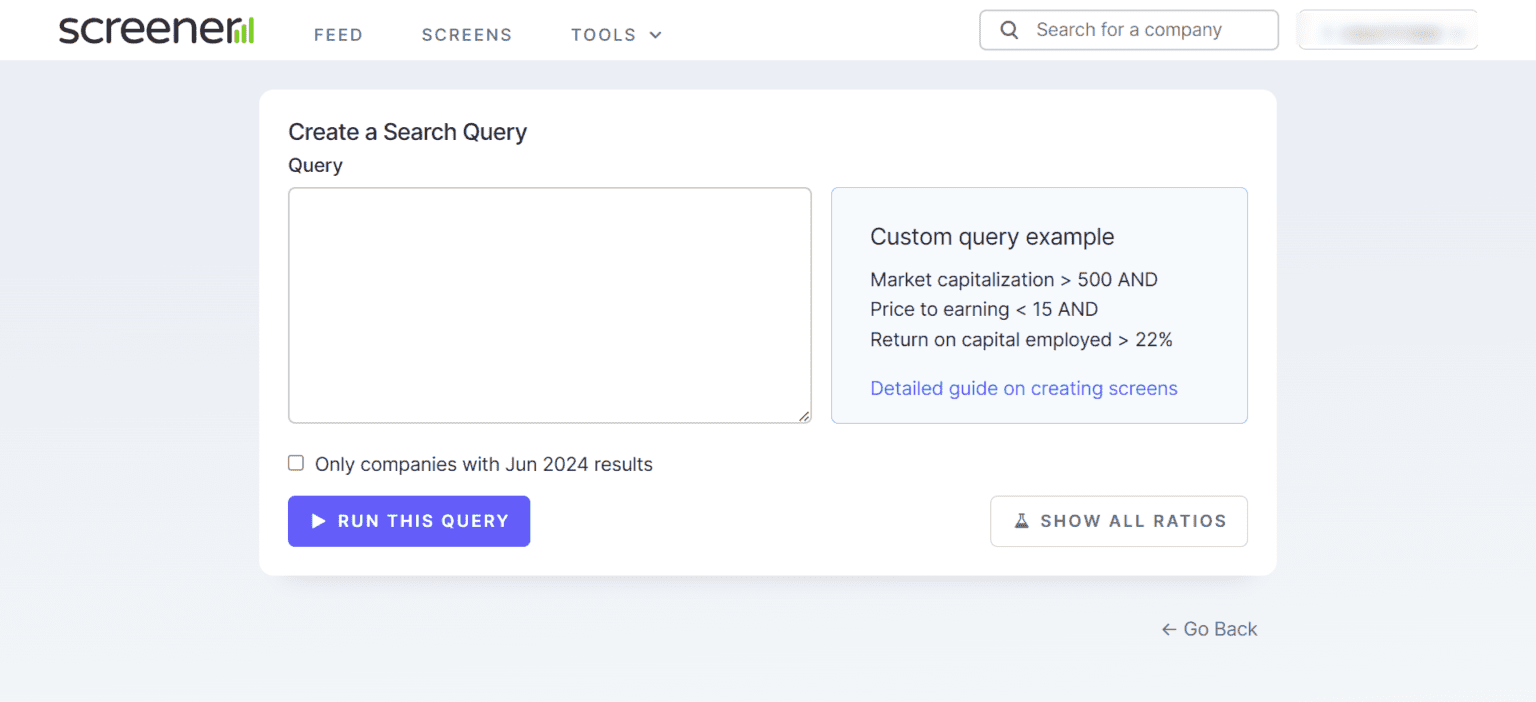

Current price < 100 AND

Market Capitalization > 500 AND

Market Capitalization < 5000 AND

Debt to equity < 1 AND

Return on equity > 15 AND

Return on capital employed > 15 AND

Promoter holding > 50 AND

Pledged percentage < 5 AND

Sales growth 3Years > 10 AND

Profit growth 3Years > 10 AND

Volume 1year average > 200000 AND

Volume 1month average > 200000

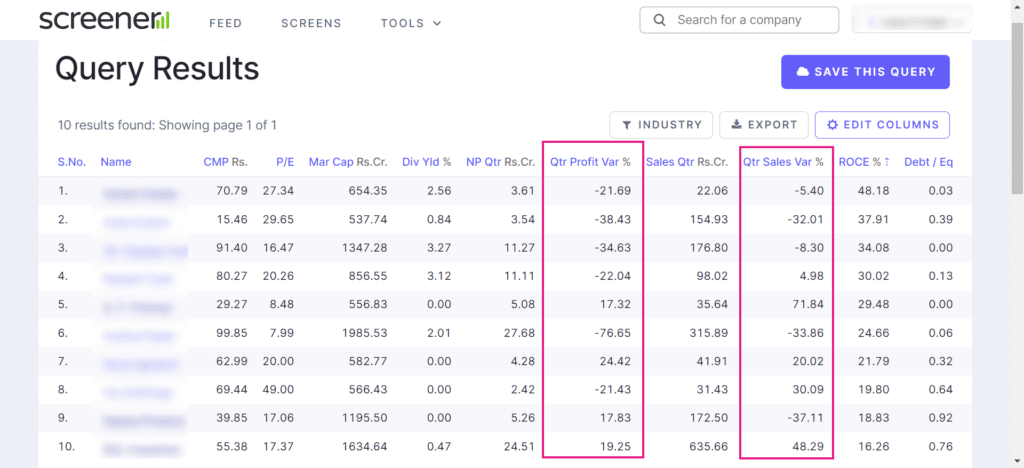

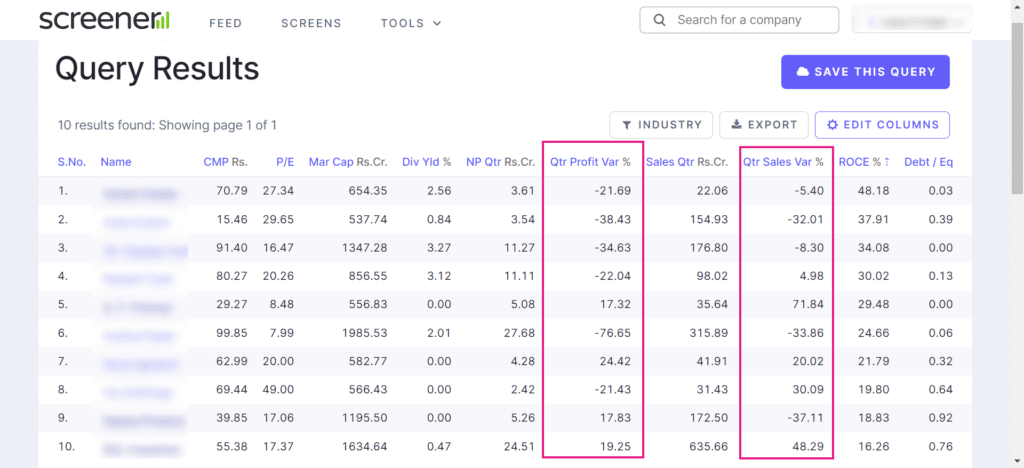

These are the queries that we need to put in the screener filter input box. Please note each query is separated by AND which means every condition should hold true. You can tweak the values and add or remove any filter criteria according to your need.

Copy and paste the above Queries and paste them on the screener filter box, then click on the Run This Query Button. If you want, you can add or remove more filters in it.

What to do after Filtering Quality Penny Stocks?

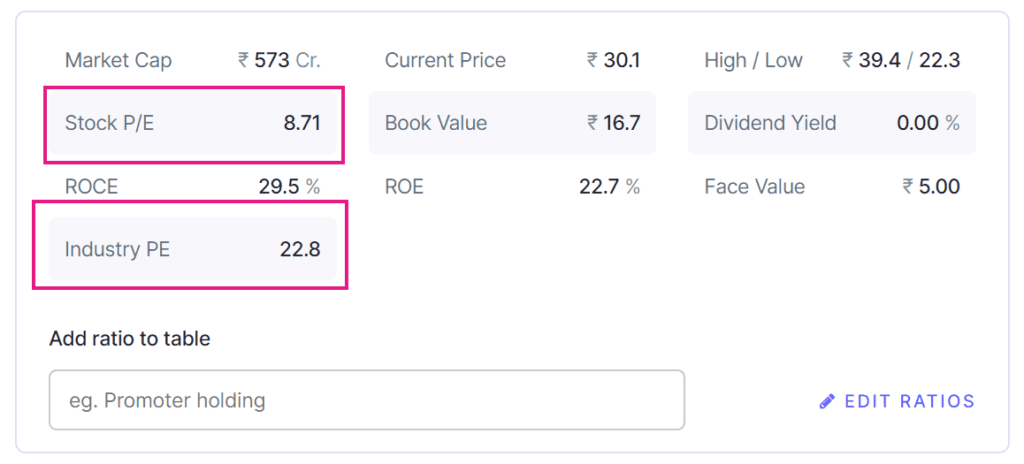

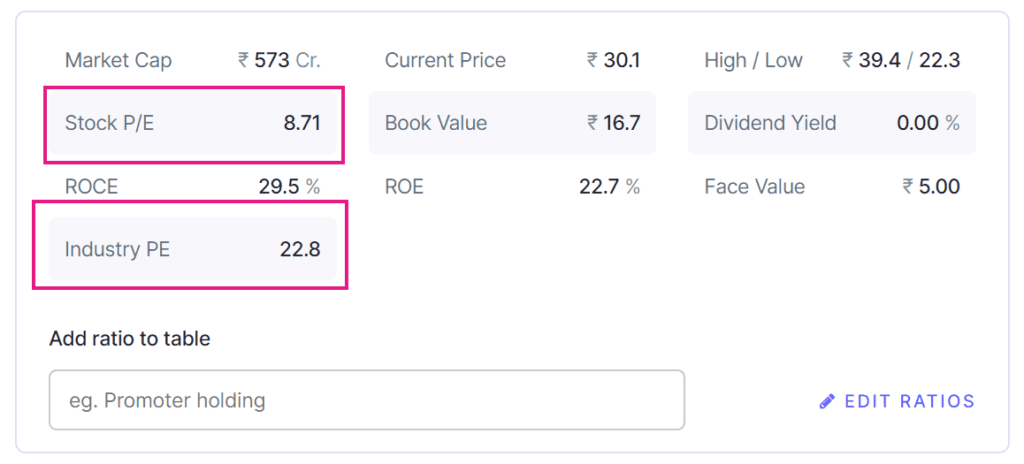

Now after filtering all these stocks, your work has only become easier, not completed. Where earlier you had to analyze thousands of stocks, now you will have to analyze only 15-20 stocks.

Price to Earning Ratio (P/E) Ratio can also be used to further analyze the filtered stocks. We did not apply the filter of the P/E ratio above because it is often higher in the case of banks. From P/E Ratio we try to find out the valuation of the company and find out whether the company’s stock is cheap or expensive. Generally, we can say that if the P/E of the company is less than its industry P/E then the company is undervalued otherwise the company is overvalued.

Apart from these ratios, you can also see Quarterly Sales Growth and Quarterly Profit Growth. They compare this year’s quarter with last year’s quarter and then see whether the company’s sales and profit have increased or decreased. The sales and profit of the company should also be increasing.

Let us know in the comments if you have any Doubts or Queries, we will try our best to resolve them.